Repayment calculator

Oct 23rd 2022

Are home loan calculators accurate?

Most Australian home loan calculators don't accurately represent how a real loan works, so their results can often be inaccurate. For an industry worth $60 billion a year, you'd think lenders could afford to get it right. So what are they doing wrong?

How loans actually work

First, a refresh of some home loan basics:

How most calculators work

Most online calculators take a lazy approach to formulating repayment schedules. After determining the repayment amount they find the number of repayments per year, depending on the repayment frequency:

Monthly:

12 repayments

Fortnightly:

26 repayments

Weekly:

52 repayments

Next they iterate over repayment periods following this pattern:

- Charge interest for the repayment period.

They calculate this by multiplying the loan balance by the annual interest rate, and dividing by the number of repayments per year. - Reduce the repayment from the loan balance.

- Repeat 🔁 until the loan balance is zero.

Here's what that looks like over few repayments, from the calculator's perspective:

Notice anything wrong with this? 🤔 Let's take a closer look...

Interest is charged too often

Calculators charge interest at the same time as weekly or fortnightly repayments. Now remember: this is wrong because interest is actually always charged monthly. Repayments are separate from interest charges.

When interest is charged more frequently it has a compounding effect. In other words, interest is calculated on top of interest that shouldn't have been added to the loan yet. This means calculators don't show the full benefit of making more frequent weekly or fortnightly repayments, instead of monthly.

How this affects calculators

Calculators severely overcalculate the interest when using weekly or fortnightly repayments. Higher interest rates would amplify the error

They have a false perception of time

While these calculators at their core are unaware of dates, it's simple for them to keep track of time as they progress through monthly repayments. There's exactly 12 months per year, so at any point they can divide the number of repayments by 12 to find how many years have passed. Easy right? Well unfortunately things get messy with weekly or fortnightly repayments. 😰

Calculators process 52 weekly repayments per year or 26 fortnights, but nerds know a year is actually 52.1429 weeks or 26.0714 fortnights.

When using weekly repayments, calculators place repayments in groups of 52 and class them as one whole year. This is because they often display yearly progress totals as a chart or summary table. This is a small difference, but over a 30 year loan it's out by over a month, or 4.287 weeks.

Note: Some calculators attempt to reconcile years of the final repayment by dividing by 52.1429 weeks or 26.0714 fortnights. This provides a more accurate loan end date (although still incorrect due to interest miscalculations). All other years in their summaries are still wrong.How this affects calculators

Calculators can't accurately reconcile weekly or fortnightly repayment schedules back to years, which skews time in yearly summary charts and tables

To add to this mess, when they calculate interest on each repayment the annual interest rate is usually divided by the number of repayments per year. That means with weekly or fortnightly repayments, 100% of the annual interest rate is being charged to slightly less than a year's worth of repayments 🤢

How this affects calculators

This causes a tiny bit of extra interest to be calculated for weekly or fortnightly repayments

They don't factor in leap years

The majority of Australian lenders use the Actual/365 interest calculation method. This means interest calculations divide the annual interest rate by 365 days, even in a leap year. Effectively every leap year an additional day of interest is charged on February 29. Calculators cannot factor this in because they calculate interest by month, fortnight, or week and have no concept of days.

How this affects calculators

Calculators under-calculate interest in leap years when using the Actual/365 interest calculation method. Higher interest rates would amplify the error

They assume months are equal

Months have odd numbers of days, so when making monthly repayments the time between both repayments and interest charges fluctuates. This affects the amount of interest calculated each month. For example, February is the shortest month so it accrues the least amount of interest.

Calculators divide a year by 12 equal periods (which works out to be about 30.4 days each), and charge 1/12th of the annual interest per month.

How this affects calculators

This causes minor errors calculating interest with monthly repayments. The amount depends on when the loan starts because certain months provide advantages, whereas a calculator would not be able to capture this. Higher interest rates would amplify the error

Additional repayment support is limited

Want to see how much interest you'd save by making extra repayments? Your additional repayments must align with your scheduled repayments to be compatible with their calculation methods. This limits the intervals you can use and ultimately how accurate their results are.

This may be unhelpful if you make extra repayments weekly, but your scheduled loan repayments are monthly.

Note: Some calculators attempt to support other additional repayment intervals by bundling them into monthly repayment intervals. For example, making an extra $100 weekly repayment will amount to $400 a month. This is very inaccurate as it would only apply 48 additional weekly repayments per year, rather than 52 🤦🏻♂️How this affects calculators

Additional repayments can't be added at exact times, which causes incorrect interest calculations

Other issues

- Most calculators use incorrect rounding methods. They do not round each transaction to 2 decimal places.

- Many use Javascript number types for dealing with floating point numbers, which causes further issues due to it's accuracy limitations.

- The often round up results. You can't see decimal places

Some make assumptions

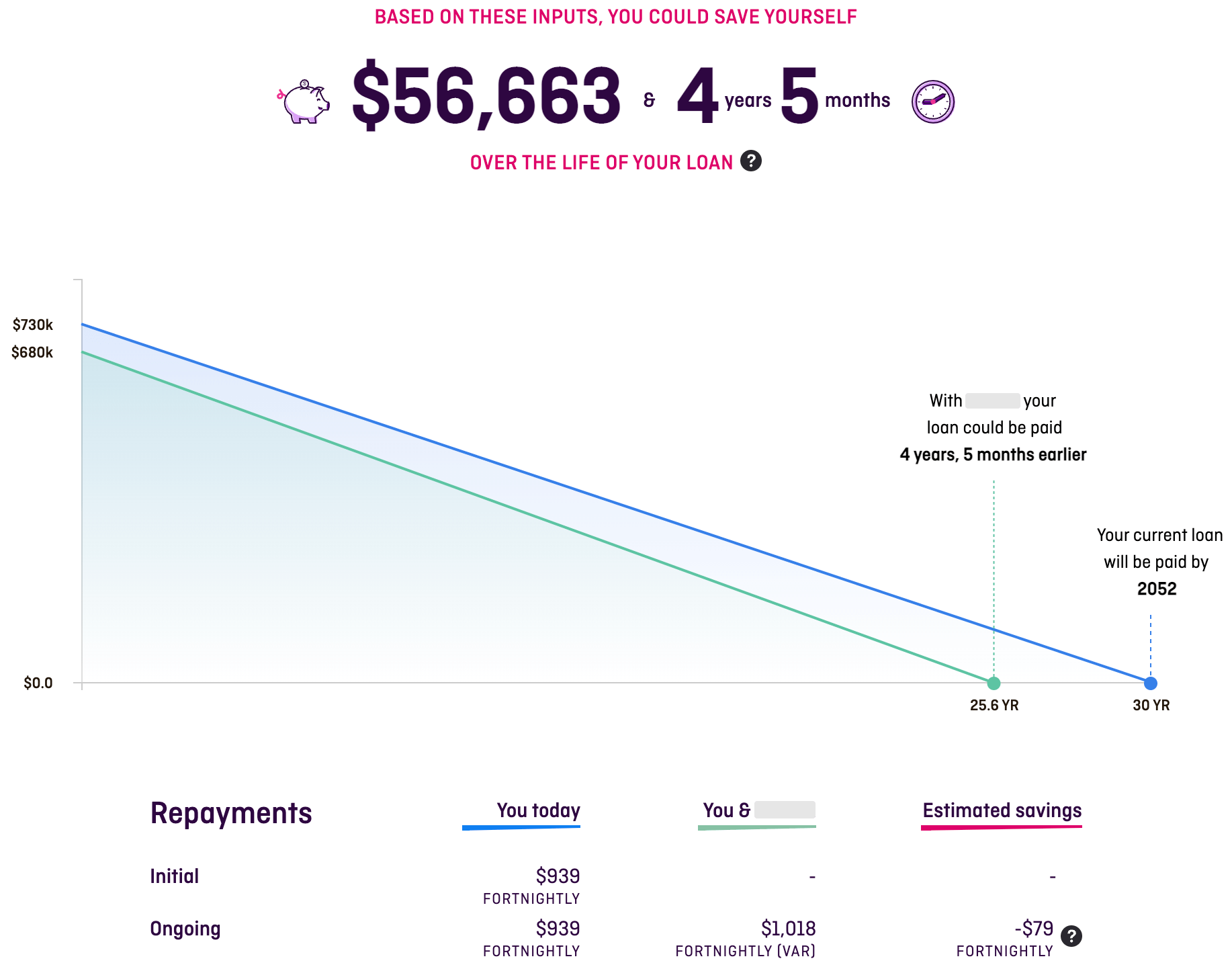

In this refinance calculator a lender shows a comparison of their loan to your current lender. It claims that despite all loan parameters being identical, their loan will be repaid 4 years and 5 months sooner and provide interest savings of $56,663.

How is this possible? Most Australian lenders calculate fortnightly repayments by taking multiplying the monthly repayment by 12 months, then dividing by 26 fortnights. Instead this lender divides by 24 fortnights (or simply half the monthly repayment amount). This essentially causes you to make higher repayments than necessary which pays the home loan off sooner.

What this calculator does not account for is that my lender also calculates fortnightly repayments using the same method, which would provide the same results. This is a dangerous assumption to make as the claims this calculator is making can be very misleading.

How inaccurate are we talking?

These examples compare a white-label loan calculator provider used by many Australian lenders.

All examples use a 30 year loan of $800,000, an interest rate of 6% p.a., and a rounded repayment calculation method (52 weeks / 26 fortnights per year)Monthly repayments

Fortnightly repayments

Weekly repayments

Monthly repayments, with extra repayments of $500 per week

Fortnightly repayments, with extra repayments of $1000 per month

Weekly repayments, with extra repayments of $1000 per month

Summary

Loan calculators:

- Can't accurately calculate interest

- Have a false perception of time when using weekly or fortnightly repayments

- Without an accurate interest calculation or sense of time, they can't calculate when the loan will be paid off

This is worrying as one of their main features is to show borrowers how long it will take to repay their loans 🤨

Conclusion

The rate of error of online loan calculators may be minimal for basic scenarios (particularly with monthly repayments), however as calculations become more complex and personalised using weekly/fortnightly repayments or extra repayments they operate with a higher level of inaccuracy.

This tolerance may be acceptable to produce quick estimates of borrowing scenarios, but with the technology available today this level of inaccuracy is unnecessary. The Australian home loan industry is huge, and consumers should expect better before committing to large financial decisions. Banks and lenders can offer increased transparency by creating more accurate calculators.

All current calculators iterate over months, fortnights, or weeks which will never be accurate. For true results they need to use days. I've built the first calculator that achieves this by running a day-by-day simulation of the entire term, to replicate a real loan. You can use it for free now.